Sales in the Italian Hardware Sector in the first half of 2025

Assofermet analyzed sales trends in the Hardware Sector in the first half of 2025, compared to the same period in 2024, broken down by product category.

The data comes from a significant sample of commercial operators active in the wholesale distribution of products primarily destined for traditional hardware stores, housewares stores, and building supply warehouses across Italy, who are members of Assofermet.

MACROECONOMIC CONTEXT

In the first half of 2025, the Italian economy recorded moderate GDP growth (+0.6%) and contained inflation (around 1.8-2%).

Household consumption remained stable, while the construction sector showed signs of slowing down after the boom linked to tax bonuses.

Relatively high interest rates impacted credit to businesses and investments, influencing the demand for building materials and hardware products.

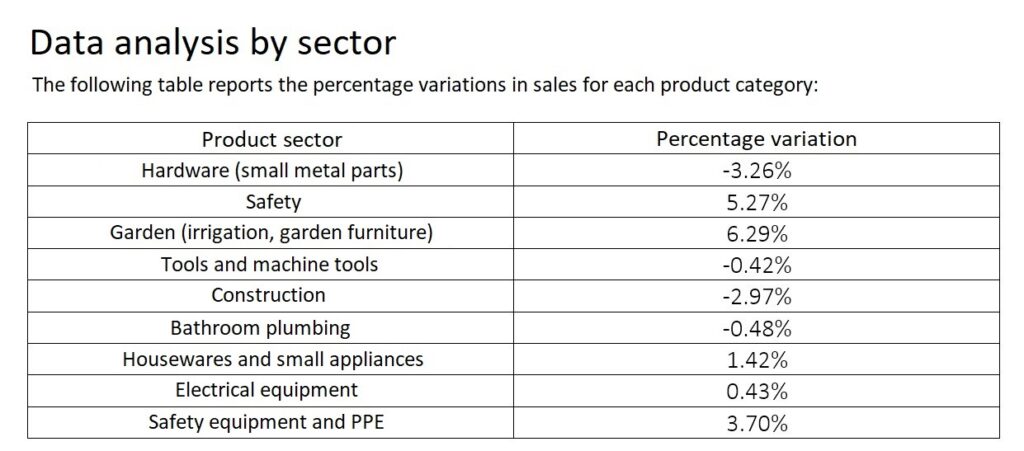

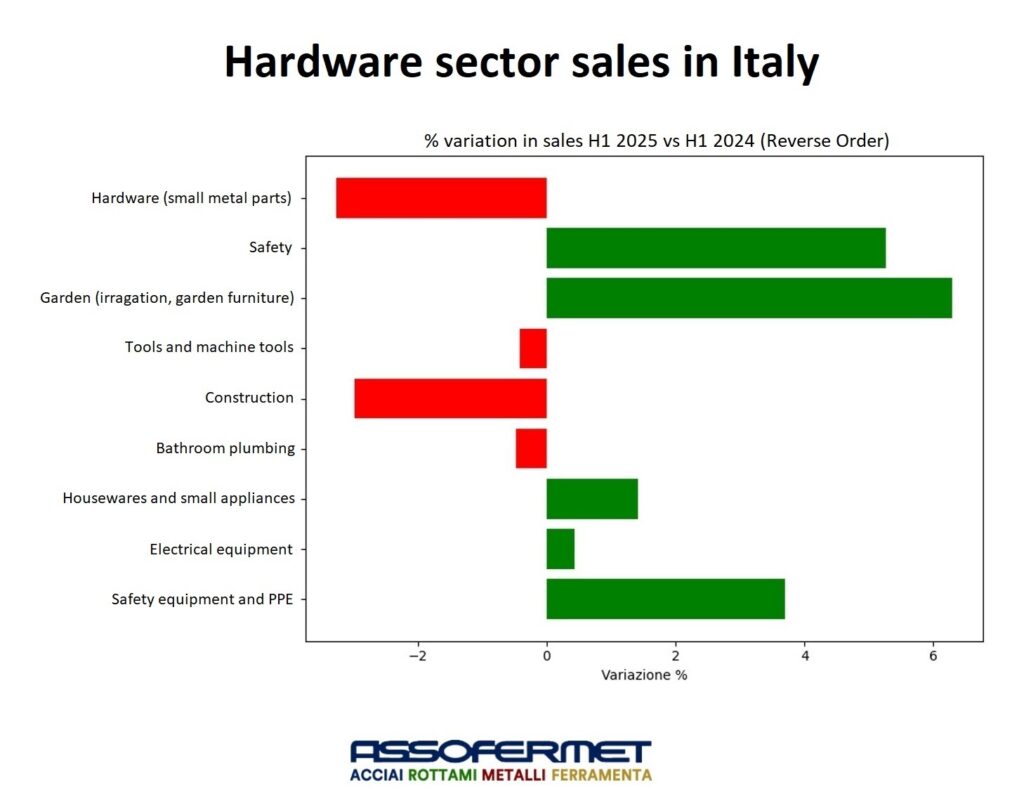

DATA ANALYSIS BY SECTOR

The following table shows the percentage variations in sales for each product sector:

COMMENT AND INTERPRETATION OF DATA

The data highlights a contraction in the sectors related to construction (-2.97%) and hardware (-3.26%), consistent with the slowdown in the building industry.

Conversely, the garden (+6.29%) and safety (+5.27%) sectors show significant growth, driven by the increase in DIY activities and greater attention to security.

Accident prevention (+3.70%) also benefits from increasing regulatory awareness. The tools, bathroom fittings/plumbing, and electrical equipment sectors record marginal variations, while housewares (+1.42%) maintain slight growth despite the competitive pressure from e-commerce.

OUTLOOKS

Stability or slight growth is expected in the Garden, Safety, and PPE (Personal Protective Equipment) segments, while the construction and hardware sectors will continue to face pressure.

It will be crucial for operators to invest in digitalization, efficient logistics, and B2B platforms to counteract the reduction of traditional retail outlets and online competition.

The DIY market continues to expand (an estimated +2−3% growth in 2025), supporting the Garden and Safety sectors. However, traditional distribution suffers from the reduction in retail outlets (hardware stores −2/3% annually) and competition from e-commerce.

ASSOFERMET, founded in 1948, is the national trade association for the sectors of commerce, distribution, and preliminary processing of steels, scrap, metals, and hardware. Today, it has over 430 member companies.