Report on the Italian mechanical engineering industry

Anima Confindustria, the category association of the Confindustria system that represents the mechanical engineering companies, provided a detailed overview of the forecasts for the production and export of miscellaneous mechanical engineering products for 2025.

The data presented clearly indicate a slowdown that has been ongoing for two years, reflecting the negative influence weighing on the industrial sector. This situation stems from geopolitical tensions, the imposition of trade tariffs, and the volatility of international markets.

The sector’s overall production is estimated to reach a value of 59.1 billion euros in 2025, registering a contraction of 1.4% compared to 2024 and confirming the second consecutive year of decline—following the 1.3% drop recorded in 2024 compared to 2023. None of the six macro-sectors represented by Anima showed growth compared to the previous year, a clear sign of the severity of the situation.

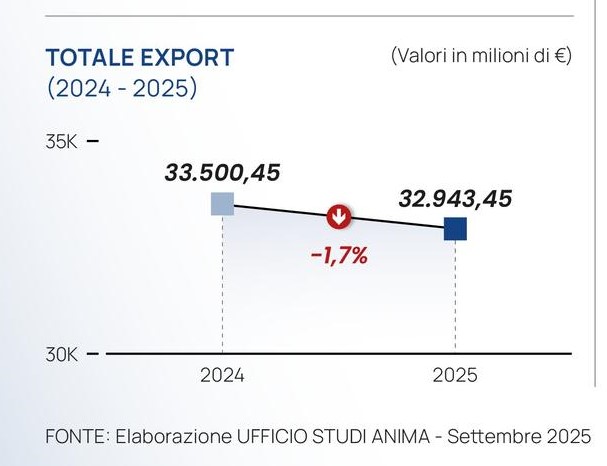

On the export front, exports for the are estimated at 32.9 billion euros in 2025, representing a decline of 1.7% compared to 2024.

This is a step back compared to the weak positive signal of last year, when exports had registered a growth of 0.7%.

This latter figure is of crucial importance, as exports remain the driving force of the sector, with the share of turnover destined for international markets exceeding 55% of total production. The contraction represents a significant threat to the competitiveness of Italian industry and, consequently, also to the national trade balance.

The main sector by revenue within Anima Confindustria is declining.

The plants, machinery, and products for the construction sector, a sector worth over 20 billion euros, is expected to fall by 2.4% compared to 2024, with exports accounting for -1.9% of this decline.

Technologies and equipment for the food industry show a drop of -0.7%. The logistics and material handling sector is expected to close the year with -0.8%. A negative year is also forecast for technologies and products for industry (-1.0%).

Going into detail, for the sector of machinery and plants for energy production and for the chemical and petroleum industry, production is estimated at 16.5 billion euros in 2025, marking a decline of 1.0% compared to 2024. Exports for the same sector will experience a contraction of 1.7%, settling at 9.6 billion euros.

The most stable sector is expected to be that of machinery and plants for human and environmental safety. Production is forecast at 5.1 billion euros in 2025, showing a slight decrease (-0.05%) compared to 2024, with growth in the domestic market impacted by a 2.0% decline in exports.

Regarding employment, the entire sector represented by Anima is expected to count over 224,000 employees in 2025, registering a reduction of 0.1% compared to 2024. Although this drop is minimal, it highlights the sector’s persistent difficulty in maintaining employment levels.

The President of Anima Confindustria, Pietro Almici, strongly reiterates “the necessity for a decisive and coordinated intervention by Italian and European institutions. The diversified mechanical industry is not an ordinary sector: it provides jobs for more than 224,000 employees, generates a revenue approaching 60 billion euros annually, and represents a significant part of the entire national manufacturing GDP. To allow the competitiveness of this sector to fade further would mean deliberately standing by, powerless, witnessing a potential drift that would threaten the country’s economic prosperity. The Federation appreciates the growing recognition shown by institutions over the last year and calls for targeted interventions that concretely address the current challenges: a coordinated response to US tariffs, the restoration of stable industrial policies to support innovation, and the constant involvement of trade associations in industrial decision-making processes.”

Despite the complex scenario, Anima remains confident and highlights the Italian mechanical industry’s tenacious ability to resist and successfully tackle this difficult time.

“Over the decades,” Almici continues, “the sector has demonstrated a capacity for adaptation and innovation in response to different global crises. However, this resilience alone cannot be enough: it is of vital importance that institutions provide the necessary support. The Transition 5.0 plan could have been a tool for recovery, but the exhaustion of funds and the resulting closure of the plan have increased uncertainty for the entire manufacturing industry. The mechanical industry represented by Anima, in fact, remains the beating heart of the Italian economy, as well as the true lever of its global competitiveness. Protecting this reality represents a matter of national interest that requires the setting of a different strategic vision and, above all, a concrete commitment from all institutional stakeholders.”

Anima Confindustria is the Federation of the National Associations of the miscellaneous and allied mechanical industry within Confindustria, which represents over 1,000 Italian companies in the mechanical sector.