Retail thefts: losses exceeding 4 billion euros in Italy

The 2024 edition of the Italian Retail Thefts Barometer, promoted by Checkpoint Systems Italia in collaboration with NielsenIQ, reveals that inventory shrinkage due to shoplifting among retail companies in Italy averaged 1.2% of annual revenues, amounting to losses of €4.12 billion and a total cost of €107 per citizen.

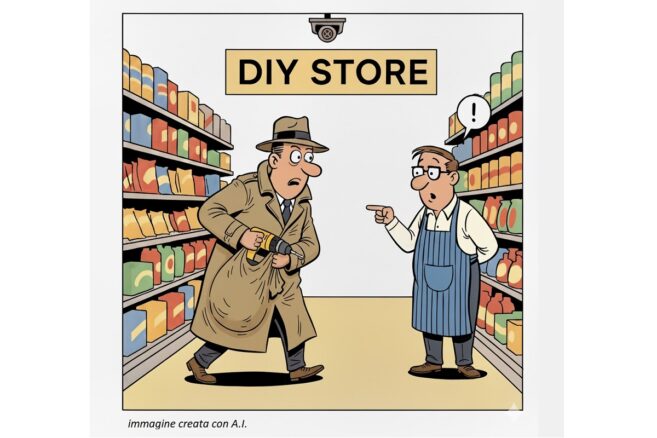

RETAIL UNDER PRESSURE: BOTH EXTERNAL AND INTERNAL THEFTS ON THE RISE

The study highlights how 53%, or over half of the losses, are caused by theft committed by potential customers in stores: a growing phenomenon compared to 2023, perceived by 84% of the companies surveyed. Among the other types of losses, there is a percentage of 21% for internal theft by employees, 15% for supplier errors, and 11% for administrative errors.

THE WINTER OF SHOPLIFTING: FOOD, HEALTH & BEAUTY AMONG THE MAIN TARGETS

The food retail sector is once again the hardest hit, representing 45% of the total losses from shoplifting. Among these, 84% stock Health & Beauty products, 74% pet supplies, 68% textiles for clothing and home, 63% electrical materials, for diy, books or stationery items, and finally, 58% offer electronics products. In terms of the incidence of thefts, the Health & Beauty sector accounts for about 19% of the total, followed by textiles and clothing with 14%.

The DIY sector accounts for 7%, while electronics stands at 5%. Closing the ranking are pet products and home decorations, both at 4%, and finally books and stationery items, which represent 2%. Although thefts are distributed throughout the year, the winter season is confirmed as the most critical, concentrating 28% of the incidents, due to the greater influx of people in the stores and the possibility of more easily concealing the merchandise.

SELF-CHECKOUT, THE NEW RETAIL SECURITY HOT SPOT

As for the locations where thefts occur, the sales floor remains the primary setting, followed by the checkouts where, with the spread of self-checkout systems, new vulnerabilities emerge: the companies interviewed agree that at these stations, the risk of shoplifting is higher compared to manned checkouts, highlighting the need to strengthen control and deterrence measures.

Today, 79% of companies report having self-service checkouts and, to address the associated critical issues, 32% have allocated specific resources to this area to prevent theft. Furthermore, 83% of the companies interviewed have enhanced security measures by introducing surveillance cameras, dedicated staff, and anti-shoplifting systems, while 33% have also implemented technology-based solutions such as RFID.

THE SHOPLIFTER’S IDENTIKIT: AGE, MODUS OPERANDI, AND AVERAGE VALUE OF THEFTS

The analysis highlights how over half of the thefts, or 53%, are perpetrated by single individuals, who are generally non-professionals and act episodically, while the remaining 47% is attributable to organized groups.

The examination of repeat offenses also offers significant insights: 54% of the incidents are attributed to subjects already known for previous infractions, compared to 46% of occasional offenders.

From a demographic perspective, two out of three companies report that 68% of the culprits belong to the 18-to-50 age bracket, confirming a predominantly adult and active profile. Minors and the over 50s account for 16% each, respectively.

On the economic level, the thefts primarily involve low-value goods: in 40% of cases, the estimated value is between 41 and 80 euros, while the remaining 60% consists of incidents of more variable value, equally distributed between values below 40 euros and over 80 euros.

The scenario is thus confirmed to be complex and evolving, involving not only the dynamics of shoplifting but also the safety of personnel in the points of sale. Both in external theft and in internal theft committed by employees, 84% of chains report a significant increase in verbal or physical assaults against staff. In parallel, 68% of companies recognize the need to train personnel to prevent and manage such incidents, while 53% highlight increasing difficulties in finding figures dedicated to security, confirming a growing pressure on the human resources engaged in the protection of the points of sale.

EVERYDAY USE PRODUCTS DOMINATE THE RANKING OF THEFTS

The NielsenIQ analysis highlights a surprisingly transversal picture: shoplifting spares no department.

From food to technology, some items are particularly exposed due to their value, frequency, and ease of theft. In Food & Beverage, the most frequently stolen items are tuna, cheeses, and products from the liquids department (alcoholic drinks and beverages), followed by coffee and cold cuts.

The phenomenon shows a clear progression compared to 2023 with a significant increase, measuring +90% for tuna and wines, spirits, and other beverages, +70% for coffee, +60% for cheese, and +40% for cold cuts and gastronomy.

In the Health & Beauty sector, face and body care products remain in first place, followed by razor blades, deodorants, oral hygiene products, and make-up. These are medium-to-high value, high-turnover items, often subjected to serial thefts.

Compared to 2023, thefts grew by 80% for face products, 60% for body care products, 70% for razors, deodorants, and specialty toothpastes, reaching a +90% increase for make-up.

Pet Food is also increasingly a target, with wet and dry food among the most frequently stolen products, followed by pet care and hygiene items.

In the textile and clothing sector, thefts are concentrated on underwear, T-shirts, footwear, and sportswear, confirming a trend that favors high-turnover, everyday-use products.

The Home and Decoration category, however, registers the highest number of thefts involving candles, air fresheners, and kitchen utensils: items of low value but high appeal.

In the DIY and Electrical Materials sector, the main targets for theft remain batteries and light bulbs, while in the Electronics department, headphones, earphones, and smartphone accessories and printers stand out, followed by smartwatches and wearable devices.

Overall, the Retail Thefts Barometer 2025 outlines an expanding and increasingly widespread phenomenon that does not follow sector logic but rather one of opportunity: from daily groceries to personal goods, from pet care to technology, shoplifters appear to be moving towards high-turnover products that are easy to conceal, often small in size but with a high perceived value.

The generalized increase in thefts, with peaks in some categories exceeding 90% compared to 2023, highlights how loss prevention is now a strategic priority for retail. This is a wake-up call that requires companies to strengthen security measures, but also to rethink sales processes and store layouts in a more careful and predictive way.

NEW RETAIL ANTI-THEFT STRATEGIES: FROM RFID TAGS TO AI

Almost all the retailers interviewed, in order to combat the phenomenon, state that they have adopted video surveillance systems (95%) and have personnel dedicated to the most sensitive areas of the sales points (95%), confirming an increasingly structured approach to security. Widely adopted are also traditional anti-shoplifting systems (89%), security barriers (95%), and spider wraps, collars, and polycarbonate boxes (84%).

These more established measures are complemented by new-generation technologies, such as RFID-based solutions (37%) and, to a lesser extent, shopping baskets equipped with RFID (21%).

Although its diffusion is still limited, RFID is emerging as one of the technologies with the greatest potential for development in the medium term: 63% of Retailers state that they do not yet use RFID technology, but 74% recognize the high added value it can offer in terms of traceability, visibility, and merchandise security. Finally, 60% of the panel is interested in introducing RFID as an anti-shoplifting system, in combination with new technological solutions based on artificial intelligence, smart tags, and antennas equipped with integrated cameras.

“The data emerging from the 2025 Barometer, presented today during the live event held at the GS1 Italy headquarters in Milan, offer an extremely clear snapshot of the challenges that Italian retail is currently facing,” declares Davide Raduazzo, Commercial Director of Checkpoint Systems Italy, who concludes: “Losses due to shoplifting and inventory differences continue to represent a significant economic impact, but the sector is demonstrating growing awareness and a strong capacity for reaction. The evolution towards advanced technologies such as RFID and artificial intelligence marks a significant step change: tools that not only strengthen security but also make it possible to improve operational efficiency and traceability throughout the supply chain”.