Brico-Garden Network: monitoring of the first half of 2025

The DIY and garden network experienced zero growth in 2025, but many chains are active in renovating existing stores and acquiring new affiliates. We analyzed the performance of 26 chains as of June 30: here are the results.

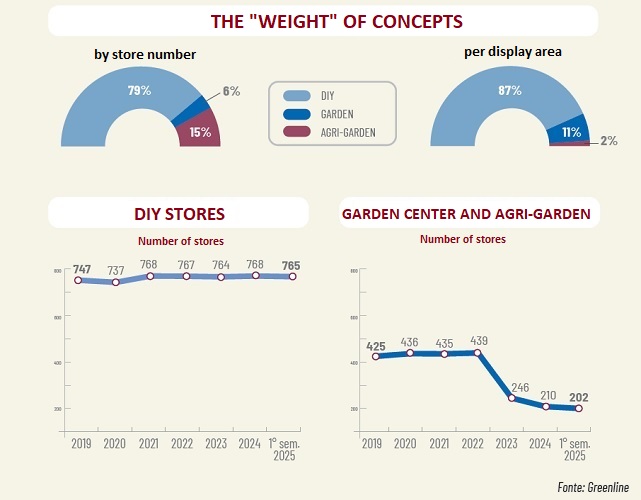

Even in 2025, the network of stores specializing in DIY and gardening products did not grow, registering a slight decline in the first semester. The decrease affected all three sectors analyzed: there are 765 DIY centers (down from 768 at the end of 2024), 54 garden centers (down from 56), and 148 agri-garden stores (down from 154). In total, we went from 978 stores at the end of 2024 to 967 as of June 30 of this year (-1.1%), with a total of 2.539 million square meters of exhibition space (-0.5%).

f we analyze the growth curve of recent years, we cannot fail to notice the impact of the 2020 pandemic, which halted the development of new stores. The resulting inflationary consequences, exacerbated by various recent conflicts, led many retail groups to renovate and strengthen their existing locations before starting new store investments.

Furthermore, the discontinuation of building bonuses suggests a reduction in those for home improvement. And we can’t forget the investments in e-commerce, which has become a fundamental and distinctive element for many specialized brands. The calm is therefore only apparent, because almost all groups are working to improve the performance of their active stores.

This is not the case for franchising and affiliation, which are the real drivers of growth: over 70% of the new stores opened in 2025 were affiliates.

ITALY’S SPECIALIZED LARGE-SCALE DISTRIBUTION IN 2025

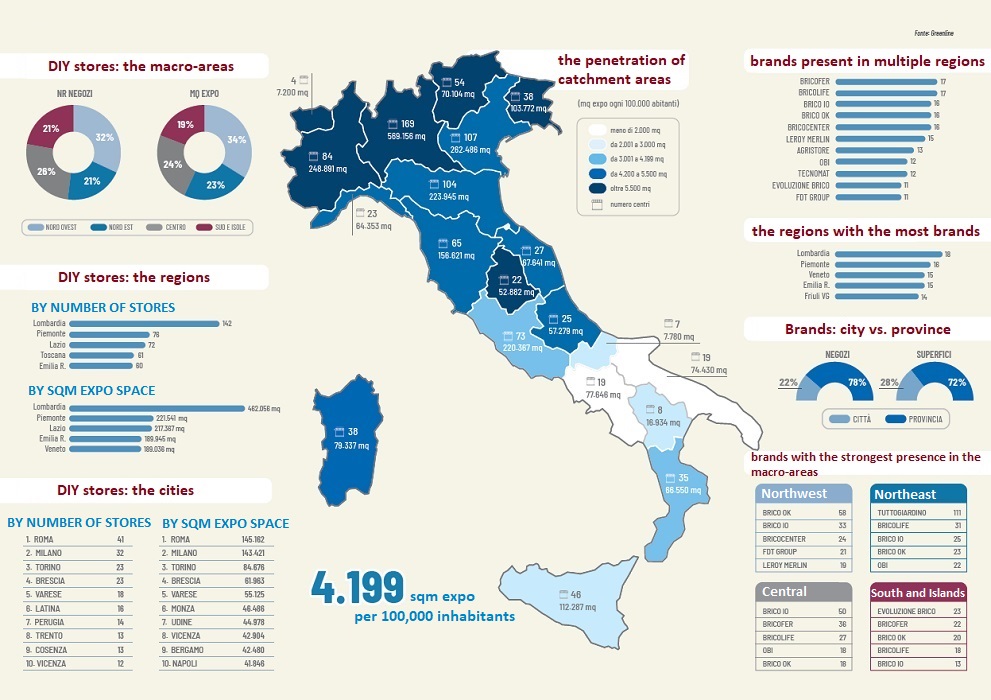

In 2025, the gap between the north and the south of the country is widening: analyzing the number of stores, the regions of the northwest and northeast lost -0.4% and -1.0% respectively, while those in Southern Italy dropped by -3.9%, with 7 fewer stores.

The largest drops were recorded in Piedmont (-4.2% in exhibition space), Calabria (-4.4%), and Sardinia (-3.6%).

Lombardy remains the region with the most stores, with 169 locations, up from 168 at the end of 2024. It also has the largest exhibition space at 569,156 square meters, which is 22% of the national total.

Lombardy also hosts the most different brands, with 18, followed by Piedmont (16), Veneto and Emilia Romagna (15). Conversely, the most widespread chains are Bricofer and Bricolife, which operate in 17 Italian regions, followed by Brico io, Brico Ok, and Bricocenter, all present in 16 regions.

DIY and garden centers are increasingly establishing themselves as a point of reference in suburban areas: only 22% of stores are located in cities, specifically provincial capitals, but they account for 28% of the exhibition space. This figure is down from the end of 2024, when they represented 23% of stores and 29% of exhibition space.

Among cities, Rome stands out with 42 stores, making it the city with the most locations and the second-largest exhibition space at 148,162 square meters. Milan, despite having 185,421 square meters, has “only” 39 stores. Other cities with a notable number of stores include Treviso (42), Brescia (28), Trento (28), and Turin (27).

If we analyze only the DIY centers, Rome still comes first with 41 DIY stores, followed by Milan (32), Turin (23), Brescia (23), and Varese (18). This ranking holds true even when we look at exhibition space, as Rome’s 145,162 square meters just slightly edge out Milan’s 143,421 square meters.

4,199 SQUARE METERS OF EXHIBITION SPACE PER 100,000 INHABITANTS

It’s evident that the most populous regions and cities attract the largest number of stores and, as a consequence, retail space. To further analyze the penetration of these points of sale within the various regions of Italy, we have compared the number of stores and their retail space to the population. We have discovered that Italians have an average of 4,199 square meters of retail space available for every 100,000 inhabitants. This is a slight decrease compared to the 4,221 square meters at the end of 2024.

In the northeastern regions, the figure rises to 5,672 square meters per 100,000 inhabitants (it was 5,704 square meters), driven by peaks in Friuli (8,528 square meters) and Trentino (6,566 square meters). The specialized retail group with the highest number of stores in the northeast is Tuttogiardino with 111 stores, followed by Bricolife (31), Brico io (25), Brico Ok (23), and Obi (22).

The northwestern regions follow with an average of 5,527 square meters per 100,000 inhabitants, thanks to peaks in Piedmont (5,688 square meters) and Lombardy (5,671 square meters). In the northwest, Brico Ok stands out with 58 stores, followed by Brico io (33), Bricocenter (24), Fdt Group (21), and Leroy Merlin (19).

The Central Italy area is quite aligned with the national average, with 4,151 square meters per 100,000 inhabitants (down from 4,162). Within this area, Umbria (5,978 sq m) and Marche (4,416 sq m) stand out, both above the national average. In Central Italy, Brico io is the most prevalent chain, with 50 stores, followed by Bricofer (36), Bricolife (27), and Obi and Brico Ok (both with 18).

The South and Islands region shows a significant lag compared to the rest of the country, with only 2,244 square meters of retail space per 100,000 inhabitants, versus the national average of 4,199 square meters. Puglia (1,839 sq m per 100,000 inhabitants) and Campania (1,333 sq m) remain at the bottom of the list. Only Sardinia stands out in this macro-area with a result above the national average, at 4,814 square meters. In the South and Islands area, Evoluzione Brico is particularly present with 23 stores, followed by Bricofer (22), Brico Ok (20), Bricolife (18), and Brico io (13).

If we shift our focus from the number of stores to the total retail space, we find Leroy Merlin in the top positions in all macro-areas, with the exception of the Northeast, where it is preceded by Obi.

CHAINS IN 2025

Most of the 26 retail groups have not reported significant growth in 2025, but there are some exceptions.

Brico io confirms its position as the chain with the most stores, with 121 points of sale. This is an increase of 4 stores compared to a year ago, with 2 new stores opened in 2025. This growth is thanks to new affiliations in Amantea (CS) and Luino (VA) last winter, a new affiliation in Vignanello (VT) on February 28th, and the direct store in San Giorgio di Piano (BO) which opened on April 11th.

Brico Ok, in second place with 119 stores, has also opened 4 new locations in the last year, all of which are direct stores. These include openings in San Vito al Tagliamento (PN) and Motta di Livenza (TV) last winter, and in Chatillon (AO) and Abbiategrasso (MI) in May of this year.

Between 2024 and 2025, Bricocenter completed the remodeling of the four stores it acquired from Self last December in Asti, Alba, Vercelli, and Borgo San Dalmazzo. The chain now has 62 stores, and it has already opened a new franchise store in Siena on July 3rd.

On April 2, Leroy Merlin opened its 53rd Italian store in Salerno. It is the fourth store for the chain in the Campania region, joining the three already in the province of Naples (Afragola, Giugliano, and Torre Annunziata). Last spring, the company renovated its Marghera store and announced a reorganization of its network in Lombardy. This includes a new store set to open in Arese in April 2026, the renovation of the Rozzano and Carugate locations, and the closure of the Baranzate, Assago, and Agrate Caponago stores.

METHODOLOGY OF THE SURVEY

The “DIY and Garden Retail Monitoring” is a biannual survey that the author has been conducting continuously since 1988. To analyze the evolution of organized specialized retail in the DIY and gardening sectors in Italy, we selected specialized retail chains (GDS) and purchasing groups (consortia, voluntary unions, etc.) that meet two main requirements: the presence of at least 3 stores and a propensity for development, which means the systematic opening of new owned (direct) or affiliated stores.

The reported display surfaces refer to the covered areas designated for sales; therefore, parking lots, offices, and warehouses are excluded.

By “direct” stores, we mean those owned by the retail group. “Affiliated” stores are those owned by private entrepreneurs who join a distribution association (like franchising) or affiliate with purchasing groups and consortia.

All data is provided by the retailers themselves and processed by the author. Rare estimations are always specified in the graphs.